ITR Filing Due Date Extended: What Is the New Deadline? Why Was It Pushed Back?

Many people wait until the last days to file their Income Tax Returns (ITR). This happens every year. Sometimes, they ask, “Will the date get extended?” In 2025, the same thing happened.

People were waiting for a new update.

Now, the government has said — yes, the ITR filing date is extended.

In this blog, we will explain:

-

What is the new deadline?

-

Why was the date changed?

-

What to do now?

All in very simple words. Easy to read. Easy to understand.

What Is ITR?

ITR means Income Tax Return. It is a form. You fill it to tell the government how much you earned and how much tax you paid.

If you paid extra tax, the government gives it back to you. If you paid less, you have to pay more.

You file this every year. You can do it online.

Who Has to File ITR?

Not everyone has to file it. But many people should.

You must file ITR if:

-

You earn more than ₹2.5 lakh in a year.

-

You are a business person or self-employed.

-

You earn money from rent or interest.

-

You want to claim a refund.

-

You want to apply for loans.

-

You plan to go abroad.

Even if it is not required, filing is good. It helps in many ways.

What Was the Old Deadline?

The old deadline to file ITR for financial year 2024-25 was:

September 30, 2025

This date was for people who do not need to audit their accounts. Mostly, it includes salaried people and small business owners.

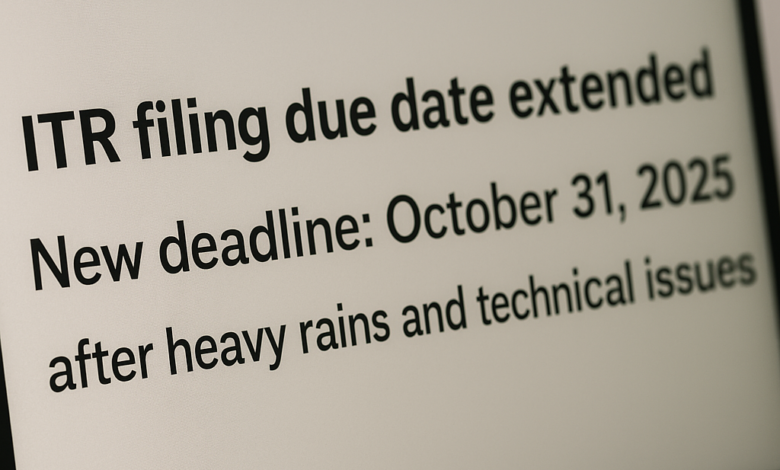

What Is the New Deadline?

Now, the new last date is October 31, 2025.

This means you get one extra month to file your return.

But don’t wait too long. File early to avoid stress.

Why Was the Date Pushed Back?

There are a few reasons why the date was extended:

-

Heavy rains and floods in many parts of India

Many cities saw floods. Offices were closed. People could not reach tax experts. Even internet and electricity were down in some places.

-

Technical problems on the ITR portal

Some users said the income tax website was slow or gave errors. The government noticed this and gave more time.

-

Festive season and holidays

September and October had festivals. Offices and banks were closed on many days. This made filing hard for some people.

-

Requests from tax professionals

Many chartered accountants and tax professionals asked for more time. They had many clients and could not finish everything in time.

What Happens If You Miss the New Deadline?

If you still don’t file by October 31, you can still file later — but it will be a late return.

And there are penalties:

-

If your income is below ₹5 lakh → ₹1,000 late fee

-

If your income is above ₹5 lakh → ₹5,000 late fee

Also, you may not be able to carry forward some losses.

Your refund will also take more time.

So, it is better to file on time.

What You Should Do Now

The best thing is to file your ITR as soon as possible. Don’t wait until the last week of October.

Here is what you can do:

-

Collect your Form 16 from your employer

-

Check bank statements

-

Download Form 26AS and AIS from the income tax portal

-

Check all income — salary, interest, rent, etc.

-

Use the correct ITR form

-

Fill in the details carefully

-

Submit and e-verify

If you are not sure, take help from a CA or tax expert.

What Is E-Verification?

After you file your ITR, you must also e-verify it.

If you don’t do that, your return is not complete.

You can e-verify by:

-

OTP on Aadhaar-linked mobile

-

Using bank account

-

Using net banking

-

Sending a physical form to CPC Bangalore

The easiest way is Aadhaar OTP.

What If You Have Already Filed?

If you already filed your ITR — well done!

If your ITR is verified and accepted, you don’t have to do anything.

Just wait for your refund (if any).

If your return has any error, you may get a notice. You can reply online.

What Are Experts Saying?

Tax experts are saying the extension is a good move. It helps people in flood-hit areas.

But they also say:

-

Do not take it easy.

-

Use this time to file properly.

-

Don’t wait till the last day.

Because on the last day, the site becomes slow. You may face errors. Then you may miss the date.

What About People Who Need to Audit?

This new deadline (Oct 31) is only for people who do not need audit.

If your business needs an audit, your due date is different.

You should ask your CA. Usually, audit return dates are in November.

Final Advice in Simple Words

Don’t wait.

Just because the date is extended, it does not mean you relax.

Start now.

Even if you don’t have all documents, start preparing.

If you don’t know how to file, ask someone for help.

But file early. Stay safe. Avoid late fee.

Filing your ITR on time shows that you are responsible. It also helps with loans, visas, and more.