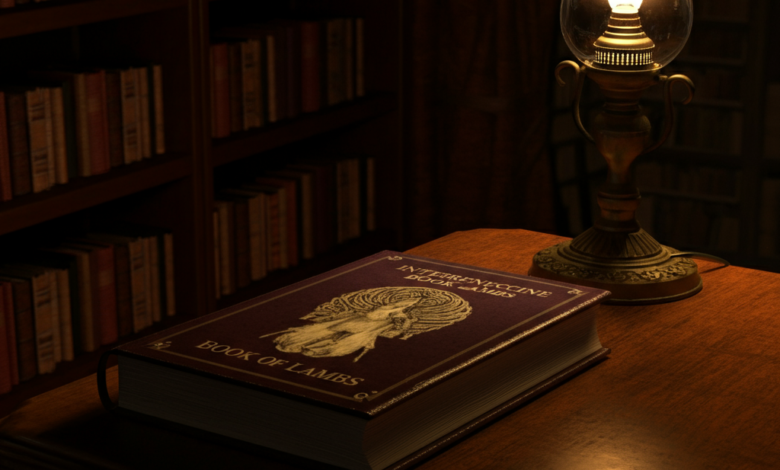

Exploring “Internecine Book of Lambs”: A Deeper Look into a Literary Marvel

“Internecine Book of Lambs” is a title that immediately captures attention with its provocative and enigmatic phrasing. For literature enthusiasts and critical readers alike, it represents a thought-provoking exploration of morality, identity, and the struggles inherent in human connections. This blog dives into the essence of the work, uncovering its key themes, literary style, and broader cultural impact. If you’re intrigued by complex characters and gripping narratives, this book may just be your next compelling read.

Introduction to “Internecine Book of Lambs”

At first glance, Internecine Book of Lambs promises an intriguing literary experience simply through its title. The word “internecine,” meaning mutually destructive, suggests a tale fraught with conflict and consequence. Paired with the softness evoked by “lambs,” the contrast alludes to a story of dichotomies and nuanced morality. Originally released on the blogspot platform, this work has gained traction among niche audiences, becoming a favorite for readers who appreciate complex narratives that demand engagement and reflection.

Through this post, we’ll explore the book’s origin, its narrative power, and the broader questions it raises. Whether you’re a literature aficionado seeking your next deep read or simply curious about emerging works, this analysis will provide you with fascinating insights.

Author Background and Influences

The mysterious author behind Internecine Book of Lambs writes under the pen name [Insert Author Name]. Their sparse online presence only adds to the allure, as readers can only piece together details of their life and influences through the themes and voice reflected in the narrative. Known for engaging with themes of conflict, betrayal, and moral ambiguity, the author draws inspiration from classics like Dostoevsky’s Crime and Punishment and the modern contemplative stylings of Ian McEwan.

What makes [Author Name] particularly compelling is their command over literary styles that bridge the gap between philosophical exploration and emotive storytelling. Their influences shine through vividly in the book, shaping its richly textured narrative and multi-layered characters.

Plot Summary and Key Themes

Centered on a small and seemingly close-knit community, Internecine Book of Lambs opens with a tragedy that exposes hidden fractures among its inhabitants. At its core, the story follows three intertwined families caught in a web of lies, manipulation, and revenge.

Thematically, the book explores:

- Morality vs. Survival: Characters must grapple with moral compromises as they seek both emotional and physical survival.

- Identity and Perception: The narrative compels readers to consider how identities are shaped and reshaped through conflict.

- Consequences of Betrayal: Acts of betrayal ripple throughout the story, highlighting the long-lasting impacts on relationships and personal psyche.

With its labyrinthine plot and morally gray characters, the narrative keeps readers questioning motivations while unraveling deeper truths about the human condition.

Literary Style and Narrative Techniques

One of the most striking aspects of Internecine Book of Lambs is its masterful blend of traditional storytelling with experimental techniques. The narrative employs:

- Unreliable Narration: Throughout the book, various points of view cast doubt on each character’s perspective, forcing the reader to actively piece together the truth.

- Lyrical Prose: The author’s penchant for vivid imagery and poetic phrasing heightens the emotional stakes of the story.

- Nonlinear Structure: Flashbacks and fragmented storytelling mimic the characters’ fractured lives, immersing the reader deeply in their turmoil.

Despite these complexities, the writing never feels cumbersome. Each sentence is intentional, driving the narrative forward while inviting readers to linger on its delicate intricacies.

Critical Reception and Analysis

Since its post on Blogspot, Internecine Book of Lambs has created a buzz among literary circles. While it hasn’t yet reached mainstream popularity, critics have lauded its bold exploration of human fragility and resilience. Celebrated book reviewer [Insert Name] hailed it as “a haunting masterpiece of character-driven storytelling.”

Audience reception has been equally enthusiastic, though not without some debate. For every reader who praises its raw emotional power, others find its dark subject matter and morally ambiguous characters difficult to digest. Still, these varied opinions underscore the book’s strength as a thought-provoking work that resonates differently depending on the reader’s lens.

Comparison to Similar Works

For readers wondering how Internecine Book of Lambs stacks up against other literary works, consider its parallels to:

- Gillian Flynn’s Sharp Objects, with its deep psychological dives into dysfunctional relationships.

- Natsuo Kirino’s Out, particularly in its portrayal of women in morally complex predicaments.

- Fyodor Dostoevsky’s The Brothers Karamazov for its philosophical depth and exploration of familial tension.

Despite these comparisons, Internecine Book of Lambs remains distinct in its voice and execution. It carves a space that feels both intimate and grand, challenging literary norms while maintaining accessibility.

Reader Interpretation and Discussion

For many, Internecine Book of Lambs becomes a conversation starter. Its deliberate ambiguity invites multiple interpretations. Was the community’s ultimate tragedy inevitable, or could understanding and empathy have salvaged its bonds? Do the characters represent broader societal archetypes, or are they deeply individualized?

The discussions sparked by the book extend long after the final page, making it an ideal pick for book clubs and reading circles.

For those wanting to get even deeper into the community behind this literary gem, there are thriving discussions in online forums and book blogs dedicated to dissecting its nuanced themes.

Why Internecine Book of Lambs Belongs on Your Reading List

If you’re looking for a book that challenges your perceptions, evokes strong emotions, and leaves you with more questions than answers, Internecine Book of Lambs deserves a spot at the top of your list. Its compelling blend of intricate storytelling, profound thematic explorations, and unforgettable characters ensure it’s not just a one-time read but a story you’ll return to for years to come.